In my 12 years of experience in retail, I’ve watched various industries shift to embrace new digital opportunities and advance economies as a vital component of their business strategies. Technological evolution has always been mission-critical in terms of future growth and success.

While enduring more than a year full of unique challenges, specifically tied to the global pandemic, organizations were forced to abruptly stop everything and adhere to a completely new set of customer wants and needs. Consumer businesses were among the most challenged industries in 2020—in their struggle, it became clear that customer expectations for digital experience leaped forward by a decade. Public health was suddenly the main factor for strategic planning to ensure business continuity. We saw an acceleration of changes in consumer behavior unlike ever before, and businesses reached unprecedented levels of swiftness in response. These changes delivered more convenience and greater efficiency and are likely to endure over the next several years.

Seismic shifts in consumer business

At the beginning of 2021, Windstream Enterprise completed our inaugural Industry Insights Survey where we asked our customers about the major changes they witnessed and their plans for the coming years when the world is fully up and running. With well over 300 responses—roles ranging from business leaders in the C-suite, to VPs, directors and engineers—we learned exactly what has been going through the minds of consumer business leaders. We documented what they’ve done to avoid falling behind, and how they plan on getting ahead.

Here, I will highlight three industry trends from this survey that we found to be both meaningful and integral to the future success of consumer businesses.

Finding 1: Greater investments in IT

Budgets and jobs were cut as a means of survival, particularly among the more challenged industries within consumer business, like retail and food service. After what could be described as a stressful year for these industries, we asked, “What’s to come in 2021?”

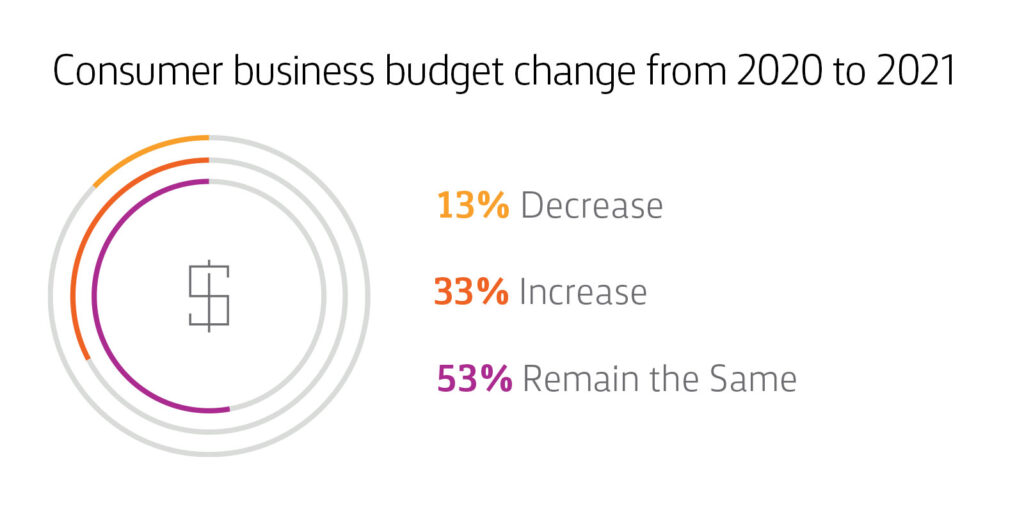

The answer was good news: better days are on the horizon. Our survey shows that 86% of executives within consumer businesses expect their IT budget to increase or stay the same in 2021. We also saw that 53% of consumer businesses see IT as a strategic advantage, which hints that further investments will be made in technologies to reinforce connectivity, business continuity and collaboration.

Times of crises are never fun to experience first-hand, but the struggles of 2020 bred innovation. They also forged newfound partnerships between line-of-business peers and IT leaders within organizations. CFOs and CEOs sat down together and analyzed customer data with a microscope and then banged on the doors of IT leaders asking to make responsive changes to protect revenue. Our survey suggests that these partnerships are here to stay, giving IT leaders an opportunity to embrace their role as advisors to their executive team and put healthy budgets in place.

Finding 2: Taking cloud into consideration

What impressed me most about my industry peers over the last year was how agile they were in meeting customers’ desires to interact more digitally, and in deploying a remote workforce.

Consumer businesses who were further along in their migration to cloud applications and infrastructure had an easier time spinning up new applications, making changes to their existing systems and dispersing their staff. In all, they had a much easier time supporting their customers and ensuring a more positive customer experience.

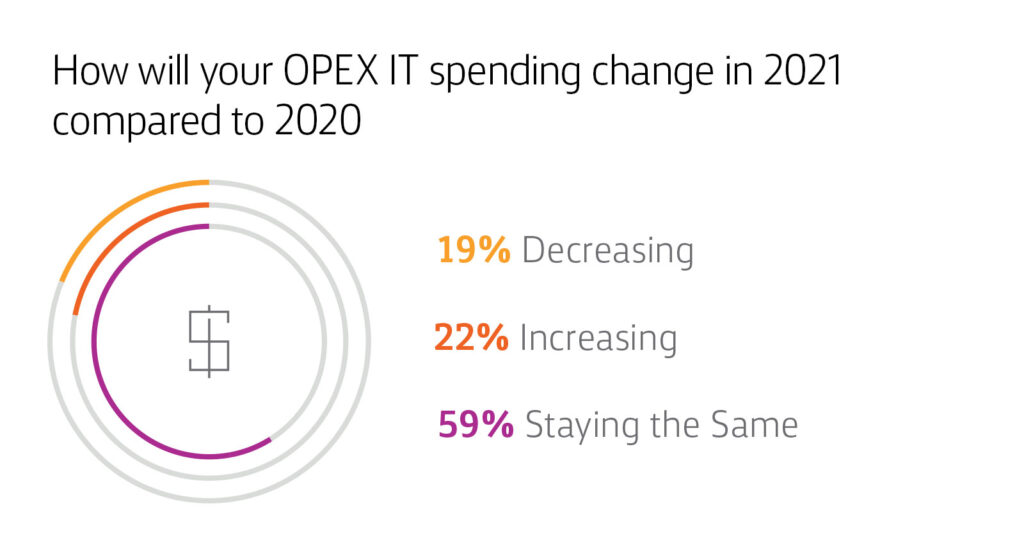

A restaurant launching online ordering could be up and running in as little as days with cloud-based store systems in place, versus weeks or months for those utilizing on-premise systems. Our survey revealed that migration to SaaS cloud-based systems is only becoming more of a priority for business leaders. Eighty-one percent of consumer businesses expect their OPEX IT spend to increase or stay the same in 2021, a vast difference when compared to 2020.

Finding 3: Investments for the future of work

Another industry trend we are seeing is a substantial increase in click-and-collect sales, as well as growth among traditional e-commerce sales. This gives consumer businesses a reason to constantly re-evaluate the purpose of their physical locations. For the same reasons that other industries are reconsidering hybrid infrastructures in place of their permanent office environments, cloud applications allow for easier change management.

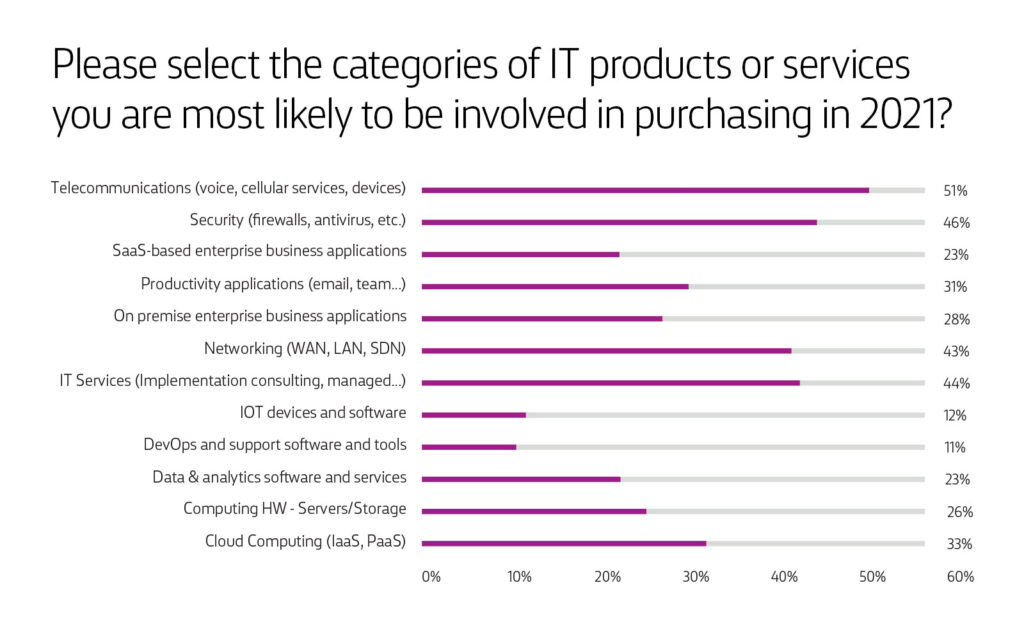

When asked what categories of IT products or services organizations are likely to purchase in 2021, our survey respondents selected telecommunications (including voice, cellular services and devices), security, and networking solutions as three of the top four technologies they are most likely to purchase in 2021. Roughly 28% of businesses intend on increasing spend for on-premises business applications in 2021. It’s believable then after prioritizing consumer-facing applications and remote workforce technology in 2020, that focus this year is shifting towards infrastructure and security.

For consumer businesses to achieve a broad-based recovery, companies need to move with the same alacrity they used to respond when they were constrained by the pandemic at the start of 2020. The actions these organizations collectively take today could create a virtuous cycle of growth of consumer consumption and productivity. Embracing IT products and services is a definite way for organizations to bypass the competition by doubling down on network connectivity and enabling solutions that promote customer engagement and collaboration.

The findings from these surveys show that businesses are starting to put in the work by investing in these solutions and giving IT leadership a louder voice at the table. But that’s not all these survey results found. Stay tuned for next month when we dive into some other interesting findings around omnichannel functionality that consumer businesses are massively trending toward in 2021.

References

- Windstream Enterprise Inaugural Consumer Business Survey, 2021.